Interview: Xamcor discusses M&A with Document Imaging Report

Strong Valuations, Active Buyers Make 2014 a Banner Year for M&A

– by Ralph Gammon, Editor, Document Imaging Report

2014 has been a banner year for M&A. With the announcements earlier this week of mega-mergers involving Halliburton and Baker Hughes and Actavis and Allergan, Thomson Reuters is reporting that global M&A has passed the $3 trillion mark for the year and is up more than 50% from 2013 levels.

The momentum has spilled over into the ECM industry, where, by DIR’s count, there have been more notable acquisitions in 2014 than in 2012 and 2013 combined. What are the reasons behind this and will the pace keep up in the future? These are just a couple of the questions we recently discussed with Paul Carman of Xamcor, one of our industry’s most accomplished M&A experts.

We first met Paul when he helped orchestrate the sale of the trade association he was running, IMC, to AIIM. This happened in the late 1990s. He followed that up with a successful stint as Senior VP, North America, for Document Boss, an M&A and executive hiring firm focused on the ECM market. In 2012 Carman joined with long-time industry analyst Harvey Spencer and Ike Fattal, who has deep background in finance, deal structuring, and M&A, to form Xamcor.

Serving the Information Management Sector, which includes ECM, Xamcor offers a variety of services including advising on M&A both from the buyer’s and seller’s side.

DIR (Ralph Gammon): From DIR’s perspective, it seems like 2014 has been an active year for M&A, do your statistics agree?

Xamcor (Paul Carman): We agree; by all measures M&A in 2014 has been extremely active and has significantly increased over 2013. In fact, through today, about $1.5 trillion in deals targeting American companies have been announced this year, the most since 2000. Acquisitions targeting American companies are up 65%. Global deal making in 2014 has also topped the $3 trillion mark for only the fifth time and is up 50% from 2013. This increase applies across the board, as well as specifically in the Information Management sector.

More importantly, valuations have held at their historic levels with no downward pressure. There are more strategic buyers in the marketplace than at any time we can remember!

DIR: Why has it been so busy and active?

Xamcor: In general, the positive economic environment in 2014 has been a huge contributor. We are seeing record stock market highs, higher employment, and a slight lessening of global tensions and areas of concern. Also, with incredibly low interest rates, debt is cheap and a very viable tool for funding acquisitions.

From an M&A perspective, in recent years we have still been recovering from the bad economy of several years ago. Because of this, there is now pent up demand for acquisition and consolidation. With the positive economy and high stock prices, companies are cash rich and have the money to spend. If they want to achieve dramatic growth that will positively affect their valuation or share price, acquisition is the primary tool for accomplishing their goals

DIR: Talk to me a little about the evolution of M&A within the information management space over the past 10 years?

Xamcor: Other than the down economic years, M&A has been extremely active over the last decade. Years ago, M&A was seen as a tool for only the largest companies. Over time that has changed dramatically; M&A is now an everyday tool for growth for companies of any size, and probably one that is still underutilized by many growing companies.

If you want to look at what has driven M&A over the last decade, you really need to start with the core element, the customer. All businesses seek to satisfy customer needs as their primary objective. The desire to satisfy ever-changing customer needs is the real impetus for acquiring. In addition, customers are seeking solutions to their diverse business problems. M&A provides a way for a company to add solutions without a long a costly development proces

DIR: What about market-share buys?

Xamcor: Acquiring market share provides the acquirer more and better ways to serve that market and a broader set of customers with new and diverse needs.

DIR: What are the major reasons you are currently seeing for acquisitions?

Xamcor: There are many reasons and sometimes those reasons can be unique to a particular company or transaction. However, in general, the key reasons to acquire may include:

- Driving Revenue Growth – Revenue can be achieved through organic growth or through M&A. While organic growth takes time, M&A can bring about dramatic growth that brings companies rapidly to higher levels of valuation.

- Market Share Growth – Increasing market share has been a principal reason for acquisitions. It can be offensive, when an acquisition is made of a similar type company to enhance share, or defensive, to remove a competitor from the market.

- Regional Growth – Many global companies have tried to expand to new geographies by building sales teams and capability in the new areas. This has proven to be a slow method, and one that has not always proven successful. Over the last decade, acquisition has been a far more effective way to enter new countries and geographies.

- Adding new technologies or technical capabilities – To satisfy user needs, acquisition can help add solutions or capabilities. In addition, it can provide almost immediate time to market, versus a multiyear development project.

- Diversification – Companies can lower risk by diversifying through acquisition. It can be used to diversify vertical markets, geographies, and solution offerings.

Some analysts have cited consolidation as a reason for seeking acquisitions. However, we believe consolidation is the result of the acquisition process, not a reason to make acquisitions. As markets mature, consolidation is a part of the general business cycle.

DIR: How are the valuations in the information management sector? Is it a buyers or sellers market?

Xamcor: In 2014, we really have had the “perfect storm” for the Information Management sector. Valuations have been at or near their historical high averages, and with a positive cash situation, buyers are willing to bid high to assure success. In some ways, we actually have equilibrium between a buyers and sellers market. In many deals Xamcor partners have done over the last several years, buyers have achieved their goals and acquisition objectives, yet sellers have realized excellent valuations and have made very profitable exits. The sellers that have achieved their goals best are those who were prepared, organized, and who had a solid exit strategy.

In addition, valuation methods have become far more equitable. Many deals are based upon a 12-month look back period, which in most cases can produce higher valuations. In the past buyers would review three or four years of past performance. With a growing company, looking back several years results in a lower overall valuation. In addition, buyers are using more sophisticated analyses, and are actually projecting the increased opportunities and value of the combined organizations, using these as the basis of acquisition valuations.

DIR: What factors drive valuation these days?

Xamcor: We have used a phrase to speak about this: “beauty is in the eye of the beholder.” Buyers have various factors they use to establish their valuation criteria, and these factors vary widely between companies, industries, and market sectors. Some of the most common factors taken into consideration are:

- Revenue and revenue trends – Is the revenue rising or declining? What is the revenue mix between software, services and maintenance? How secure is the continuing revenue stream?

- Earnings / EBITDA trends – the ability to count on the earnings projected and future earnings trends.

- Management team – In many cases, this is the top item of importance to an acquiring company. They want to be sure that key people remain and revenue goals are achieved after the acquisition is closed.

- Product & Solution Quality – Age and quality of the software or solution, forward-looking development plans, future projections for the need for the solution.

DIR: Are traditional information management technologies like capture and ECM losing value?

Xamcor: Again, there are many answers to this question. In general, the answer is a definitive, “No!” Capture is a critical first step in any information process. While the nature of capture changes, the need does not. In addition, the number of independent capture companies has gone down over the last years. We believe this makes the remaining companies even more valuable in the future.

ECM is another important technology segment. As it matures, ECM still has a valuable place as a cost-saving solution. Valuations of ECM companies have held strong and will hold strong into the future.

The value of a company depends far more on the performance and quality of the company than it does on the technology sector it is in. A growing, progressive company with a strong management team, a solid strategy, and a capable organization will always earn a premium valuation and offer the strongest fit for a quality strategic buyer.

DIR: What does 2015 look like regarding M&A in the information technology segment?

Xamcor: Xamcor is predicting that 2015 will be a very busy year for M&A, perhaps a record year. However, any forward projection is based on economic conditions and the earnings we see in the Information Management sector.

What will drive M&A is the continued industry trend toward consolidation that we have seen over the past years. In addition, customers are demanding more efficient solutions, and would prefer to work with a single or small number of key vendors. However, there are some potential warning signs appearing. The economy in Europe, and especially in Germany, seems to be slowing. If this trend continues, it could slow some of the M&A activity.

DIR: Looking at the categories DIR has developed for acquisitions in the past 10 years, which ones do you see as being the most prominent in 2015?

Xamcor: We believe most of the categories you have examined will continue to be very active. In general, and taking the liberty to combine a few categories, we see the following as continuing:

- ISVs will continue to acquire software assets to achieve growth, add customers, and add market share.

- Software companies will continue to acquire to buy market share, expand their solution offerings, add customers (who are upgrade prospects), and dramatically expand revenue and earnings.

- Traditional hardware companies will acquire to diversify. As hardware becomes commoditized, hardware companies need to add value to their core hardware offerings. Adding solution functionality, driven by their hardware, will expand their market and make hardware offerings more valuable.

- Financial companies (PE firms, VC firms) will continue to invest in the sector. Much of this investment will support the above categories.

DIR: If I was thinking of selling my company in the next few years, what should I being doing now to prepare?

Xamcor: This is an important question. Many times, companies approach Xamcor and tell us they are ready to sell. When we look into the company, its structure, and its operations, we always encounter various components that if optimized and changed, the result would be a significantly higher valuation. So learning from this, the number one tip is to prepare well in advance. In the years prior to exit, the nature of decisions will change. The correct decisions become those that will drive optimum value.

Even if a company is not planning to exit in the short term, I would encourage them to create and embrace an M&A strategy. In this way, if approached, they would have a complete decision matrix built to assist them in assessing even unsolicited offers.

One of the hardest lessons to convey revolves around timing. Many companies try to plan an exit based on a calendar or some performance standards. Our advice is even simpler; the best time to sell, at maximum valuation, is when a company is performing best! When a company is growing rapidly, it is sometimes difficult for them to consider a possible exit. Yet many surveys over many years prove that this is the optimum time to have exit or merger discussions!

While you asked about sellers, the same is true for buyers. Before buying, we strongly recommend a detailed M&A plan be created and used as a blueprint for success.

DIR: Thanks Paul. So, for any one interested in buying or selling an Information Management business, is there any initial commitment involved with reaching out to Xamcor?

Xamcor: The goal of Xamcor is to help our clients grow and succeed. To do that, we want to learn all we can about our clients and potential clients well before there are any costs or invoices generated. To accomplish that, we always offer a free consultation to understand a prospect’s goals and to provide them with feedback from our team regarding those goals. Over the years we have given many man-hours of advice and guidance at no charge! We encourage your readers to speak with us at any time.

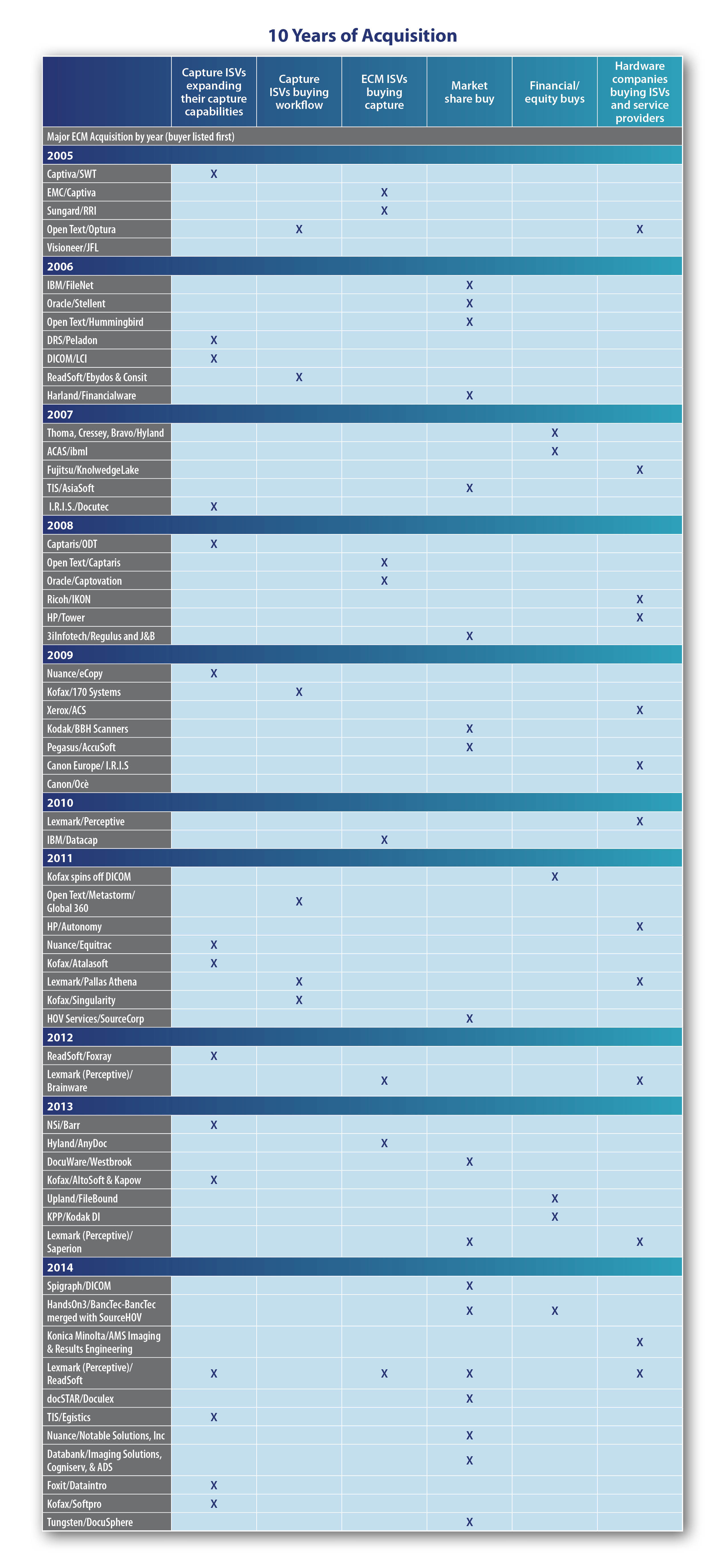

At the Capture 2014 Event, DIR had a lively discussion regarding the history of acquisitions in the sector. This chart summarizes that activity: